Conference Schedule

Expert know-how you can immediately apply.

In this talk I will share my experience of building an energy trading business from scratch. We will go step by step through the problems that had to be solved, the design decisions that were made and will see an example of the full quant platform solution built entirely in Python.

Close

Julia is a relatively new language built for numerical and scientific computing that combines the flexibility and productivity of dynamic languages with a performance close to C. Its features make it ideal for use as a single language across prototyping, modelling, and production in the the financial domain.

In this talk, we will discuss some of the innovative features of the language that make it particularly suited for high performance computing in finance. We will see how the key design feature of multiple dispatch makes mathematical programming easier as well as high performance computing; how Julia's inbuilt distributed computing facilities allow quick parallel programming; and how Julia's awesome foreign function interfaces allows easy reuse of code from C, Python, Java, etc.

Close

Open source languages, like Python, R, Julia, play an important role these days not only in data science but in Quant Finance as well. However, it is seldom the case that quants can get by with only a single language. Every language has its major strenghts and the real power of open source only materializes when using a blend of such technologies.

Deploying multiple such technologies, however, easily can cause sleepless nights for IT departments. The talk illustrates how Quant Platform solves that issue elegantly. The platform makes use of a modern, Web-and browser-based deployment concept based on, among others, cloud infrastructure and Docker containers.

Close

AHL is a quantitative investment manager and an early adopter of systematic trading, committed to technology to provide a productive environment for its quants to research, construct and deploy new trading models. AHL has a large amount of experience running automated quant strategies. In 2011, we started taking Python seriously and took our best practices over to it whilst also learning some more.

In this talk, James Munro will take a research idea and turn it into an autonomous trading strategy that can be used in production. He will explore techniques for writing code that works across research and trading environments, from the structural pattern that it implies to the tests and alerting systems that you need. You’ll also hear about some techniques for dealing with missing and dirty data and the importance of understanding the differences between a back-test and a real-world trading strategy.

Close

We introduce Lua, a relatively unknown language in the financial industry, which has been used in many industrial applications (Adobe's Lightroom, Blizzard's World of Warcraft, Cloudflare and more).

Following a quick overview of its main features and a cursory glance to its syntax, we focus on scientific computing with Lua with financial applications as motivating examples. Comparisons are made with other languages used in the field: C++, R, MATLAB, Julia, Python.

Close

We shall discuss how to create CTA style strategies. In particular, we shall develop a trading strategy which mimics the benchmark for trend following funds, discussing the impact of ideas such as volatility targeting to P&L.

Later, we shall discuss the open source PyThalesians Python library, explaining the benefits of open sourcing software. We shall go through example code for a trend following strategy in FX and also discuss other features of the library like visualisation.

Close

R/Rmetrics is a premier open source software solution for teaching and training quantitative finance. With more than 40 R packages for computational finance and financial engineering developed by 22 programmers worldwide Rmetrics offers state-of-the-art algorithms for applications in Finance and Insurance. Our R packages that manage chronological objects in R are listed in the Top 100 of the contributed R packages.

In this talk we give a brief overview about the statistical environment R and Rmetrics applications in finance. A show case concerned with stability concepts for investment decisions using Bayesian statistics and Wavelet analysis will show the power of R/Rmetrics. We also present the openess of R and discuss communication links to C++ and Python.

Close

AHL is a systematic hedge fund where data is central to the business. Challenged by performance and scalability problems when storing and retrieving time series data using traditional data stores, we built our own.

Arctic is the result of that work. It’s a high performance time series column store built with Python on MongoDB. With compression and chunking arctic gives query performance orders of magnitude better than commercial (and open source) dedicated time series databases. We ingest 1.4 billion ticks per day, and read data at millions of rows per second (in pure Python). Our aim is to efficiently ship data to cheap compute, rather than run all computation on expensive (in software/hardware terms) dedicated database servers.

The talk explores the solution space of existing time series data stores, and the route we’ve taken to build a simple library with a beautiful API for numeric data storage.

Close

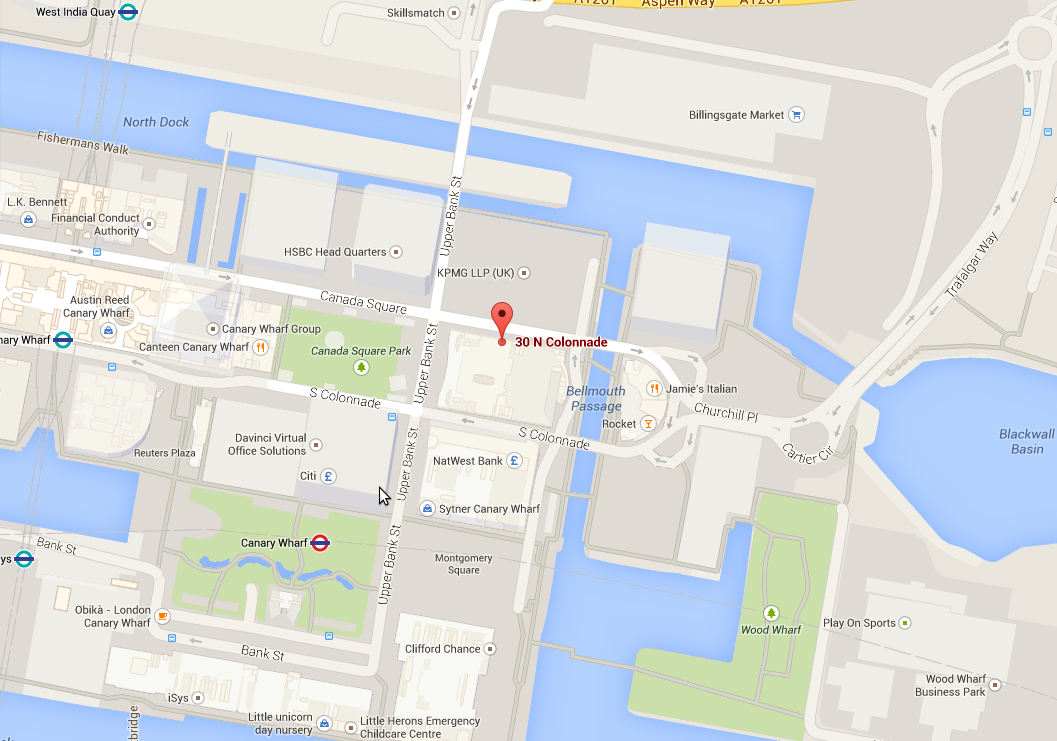

| 8:00 |

|

Registration and Morning Coffee |

|

|

WELCOME & OPENING REMARKS |

| 9:00 |

Dr. Randeep Gug

CQF Institute |

Welcome and Opening Remarks |

| 9:10 |

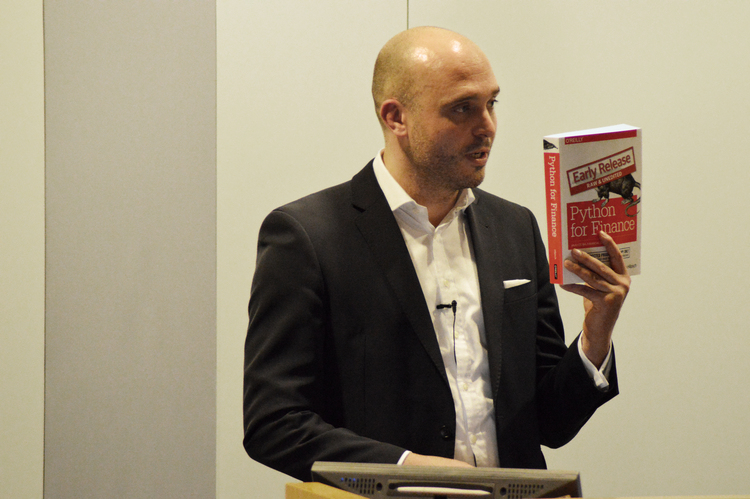

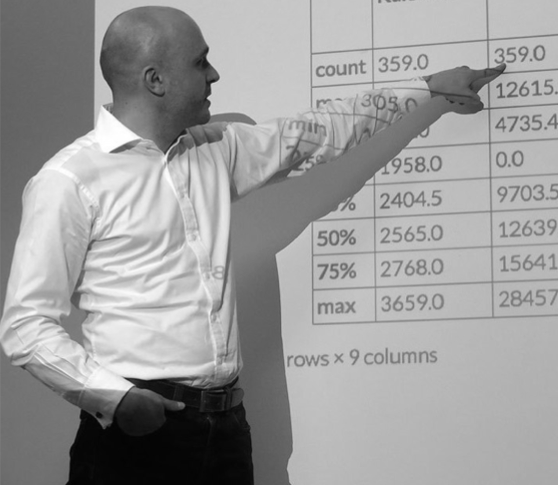

Dr. Yves Hilpisch

The Python Quants |

Quant Tech — Where Do We Stand? |

|

|

LESSONS FROM INDUSTRY |

| 9:30 |

Dr. James Munro

AHL |

Quant Strategies: From Idea to Execution (Abstract) |

| 10:05 |

Dr. Teodora Baeva

BTGPactual |

Lessons Learnt from Building an Energy Trading Business from Scratch with Python (Abstract) |

| 10:40 |

|

MORNING BREAK |

|

|

PYTHON QUANT TECHNOLOGIES |

| 11:10 |

James Blackburn

AHL |

Arctic — A Python Library for Fast Time Series Storage (Abstract) |

11:45 |

Saeed Amen

Thalesians |

How to build a CTA with PyThalesians (Abstract) |

| 12:20 |

|

LUNCH BREAK & HIGH FREQUENCY NETWORKING |

|

| 13:40 |

Dr. Yves Hilpisch

The Python Quants |

Quant Platform — Bundling the Best of Open Source for Quant Tech (Abstract) |

|

|

LEARNING FROM OTHERS |

| 14:15 |

Avik Sengupta

Algocircle |

HPC with Julia in Finance (Abstract) |

14:50 |

|

AFTERNOON BREAK |

|

| 15:15 |

Dr. Stefano Peluchetti

HSBC |

LuaJIT Numerical Computing for Quants — Minimalist Efficiency (Abstract) |

| 15:50 |

Prof. Dr. Diethelm Wuertz

ETH Zurich |

R/Rmetrics in Finance for Python Users (Abstract) |

|

|

PANEL DISCUSSION, RAFFLE, CLOSING REMARKS |

| 16:30 |

Expert Group |

Is QuantTech the Next FinTech? |

| 17:00 |

|

Book Raffle and Closing Remarks |

| 17:30 |

|

Conference Closing, Get Together |